Accessory dwelling units (ADUs) can add value, flexibility and connection to your property.

Whether used as a home office, guest suite, rental, or a home for aging parents, an ADU’s

purpose can shift with your needs over time. Planning for that evolution from the start will help

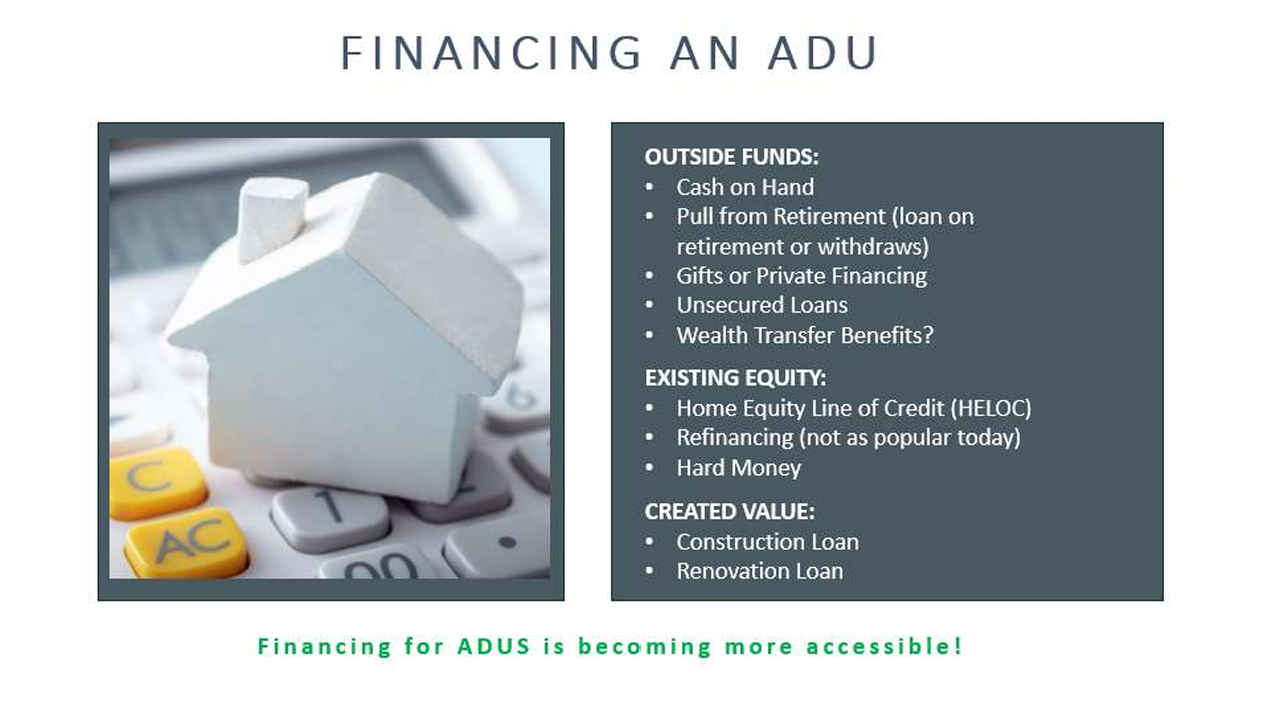

you get the most out of your investment. While there are many ways to finance an ADU, the

best strategy is one that aligns with your goals and maintains your family’s well-being at the

heart of your plan. Financing ADUs is becoming more accessible than ever, with growing

support from lenders and new programs designed to meet the needs of homeowners. In this

article, we’ll walk through the various financing options, with expert insight from the ADU

Finance Guy, Charles Edington.

Cash-Out Refinance

If you’re sitting on a pandemic era interest rate, this likely is NOT the option you’ll want to take,

however, for everyone else, a cash-out refinance option might be a good fit.

Things to consider: You’re resetting your mortgage term, and monthly payments may rise.

Home Equity Loan (HELoan) & Home Equity Line of Credit (HELOC)

- HEL: A one-time lump sum with fixed payments.

- HELOC: A revolving line of credit where you draw what you need when you need it.

Pros: Interest may be tax-deductible when used for improvements, and you keep flexibility.

With a HELOC, you can borrow funds in stages – taking what you need when you need it. You’ll

pay interest only on the amount drawn, have the option to repay or re-borrow within your

credit limit, and adjust payments during the draw period, which is ideal for phased construction.

Things to consider: HELOC rates can adjust, so plan for possible rate changes over time.

Construction-to-Permanent Loans

Also known as “one-close” financing, this loan lets you complete a single closing at the start of

your project, access funds in draw increments as construction progresses (often paying interest

only during the build) and then seamlessly convert to a traditional mortgage once your ADU is

complete – saving you extra costs and paperwork.

Pros: Only one set of closing costs (no need for a second loan application) and you pay interest

only during construction.

Things to Consider: Requires strong credit, proof of income, and possibly larger down payment

than standalone mortgages.

Renovation Loans

Fannie Mae, Freddie Mac, FHA, and VA each have loan programs which allow you to roll

purchase and rehab, or standalone improvements, into a single loan.

Pros: Lower down payments and more relaxed credit requirements, but loan limits apply.

Things to Consider:

- Debt-to-Income Ratio: Lenders will crunch the numbers on your existing obligations.

- Loan-to-Value Limits: Equity loans typically cap at around 80–90% of your home’s

appraised value. - Cash-Flow Projections: Estimate realistic rents, factor in occasional vacancies, and

budget for ongoing maintenance.

Financing an ADU for Aging Parents

Nothing beats the peace of mind that comes from keeping family close. ADUs can offer seniors

independence while preserving precious family connections. Here are three scenarios for

financing to build with and for family members.

1. Adult Children as Primary Financiers: You tap into your own equity or savings to build a thoughtful space for your parent.

Pros: You often qualify for better rates, and your parent lives rent-free or agrees to pay a

fixed rental amount each month.

Things to Consider: Agree on whether it’s a gift or a loan, as clear expectations make for

happier families.

2. Aging Parent Funds the Build: Your parent uses their home equity, savings, or

a reverse mortgage to create their retreat.

Pros:

- They maintain ownership and autonomy, while keeping debt off the adult child’s

plate. - Using home equity or personal savings allows parents to fund construction directly.

When they later sell their primary residence, proceeds can be used to pay off any

HELOC or loan, and the sale may qualify for the IRS primary residence capital gains

exclusion. Additionally, financing the ADU can act as a tax‑efficient way to transfer

wealth to adult children, leveraging annual gift‑tax exclusions and lifetime

exemption rules (consult a tax advisor for personalized guidance).

Things to Consider:

- Reverse mortgages carry closing costs, mortgage insurance premiums, and ongoing

interest fees; they can diminish inheritance, so consult a HUD‑approved counselor. - Home equity loans and HELOCs require monthly repayments, so be sure to plan for

this expense. Regardless of the funding method, draft a clear, written agreement

outlining financial responsibilities, repayment terms, and ownership rights for all

parties involved.

3) Shared Investment: You join forces – with both names on the loan to blend credit

strengths and split responsibilities.

Pros: Access to larger financing and shared ownership.

Things to Consider: Draft a co-ownership agreement covering cost shares, maintenance

duties, and an exit plan if circumstances change.

Next Steps

- Review Your Finances: Check your credit profile and equity position.

- Compare Lenders: Gather a few personalized quotes for each financing option.

- Lean on the Experts: Talk with a financial advisor or ADU specialist to tailor a plan that

feels right for your family. A complimentary consult with Shelter Solutions will first give

you a ballpark estimate for the general amount you should seek to fund.

Reach out today for your complimentary ADU consultation, followed by a free financing

consult with Charles Eddington (adufinanceguy.com) to explore your financing options. This

way, you’ll move forward with confidence with the understanding of an estimated project cost

financing options that align with your long-term vision.

Coming Soon: ADUs as a Wealth-Transfer Strategy

In this article, we touch on how parental funding of an ADU can end up as way to transfer

wealth to an adult child. We’ll dive further into how building an ADU can serve as a thoughtful,

tax-efficient way to transfer wealth across generations; without the usual gift-tax or capital

gains pitfalls. We’re pulling together the latest insights and expert guidance, and we can’t wait

to share what we uncover. Stay tuned for a deep dive that will help you plan for both family and

financial legacy.

Disclaimer: The information in this article is provided for general informational purposes only

and does not constitute financial advice. Always consult your financial advisor or tax

professional before making decisions related to your personal finances or ADU financing

strategies.